MAP is a mechanism laid down in tax treaties(E.g. DTAA) to ensure that taxation is in accordance with the tax treaty.

- A tax treaty is a bilateral (two-party) agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens.

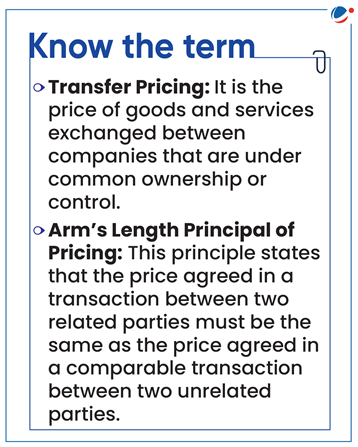

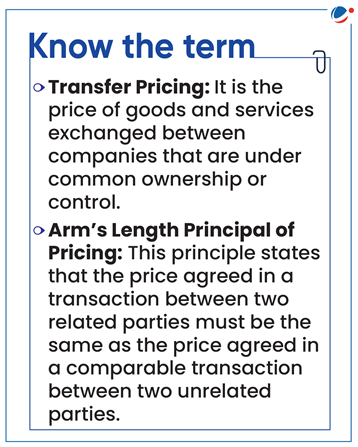

- MAP resolves transfer pricing disputes while APAs prevents transfer pricing disputes.

- Tax payers file MAP for pending disputes while they opt for APA for same transactions for future years as an effective dispute resolution/ avoidance strategy.

Significance of APAs

- Double Taxation Avoidance: Clarity with respect to tax outcome of the tax payer’s international transactions reduces the risk of potential double taxation.

- Promoting ease of doing business: Especially for Multinational entities which have a large number of cross-border transactions within their group entities.

- Reduction of compliance costs to companies: It eliminates risk of future tax audit and time consuming tax related litigation.

- Reduced cost of administration: Due to reduced future tax litigation, reduced time and effort are needed on audit tasks by tax authorities and consequently it also frees scarce resources of government.

- Less burden of record keeping: As the taxpayer knows in advance the required documentation to be maintained to substantiate the agreed terms and conditions of the agreement.

Indian Advance Pricing Agreement Regime:

APA Scheme in India:

- Ministry of Finance had notified APA Scheme in 2012 through the insertion of sections 92CC and 92CD in the Income-tax Act, 1961.

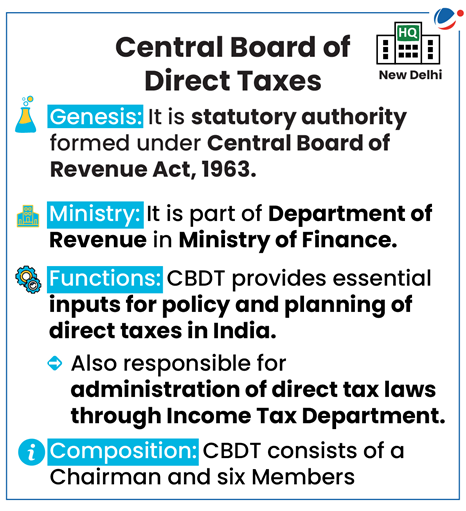

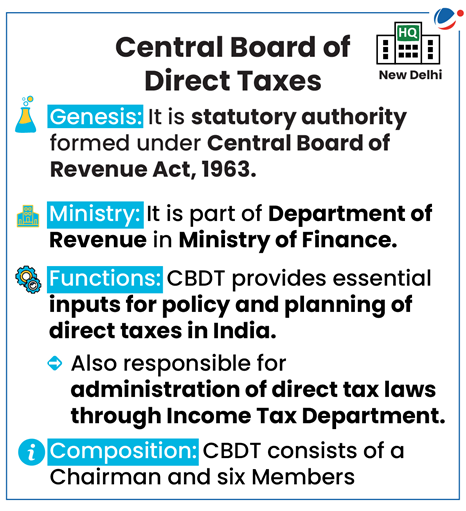

- APA rules were notified by CBDT subsequently.

- Under it, an agreement is signed between CBDT and any person determining in advance arm’s length price in relation to an international transaction.

- Nature of Scheme: APA process is voluntary and supplements appeal and other Double Taxation Avoidance Agreement (DTAA) mechanism for resolving transfer pricing dispute.

- Term of APA: Maximum five years.

- Rollback provisions: Allows Arm’s Length Price as agreed in APA, to be rolled back to a period prior to the commencement of the APA.

Issues with Advance pricing Agreement in India:

- Complex International transactions: Many international transactions involve intricate business structures and operations, making it challenging to accurately determine arm's length prices.

- Lack of Internal Co-ordination: It has been experienced that different entities take different technical positions on similar international transactions. Creating uncertainty for taxpayers and stalling of APA negotiations.

- Delay in Processing APAs: Scarce human resources allocated to the process leads to delay in processing as process is usually fact intensive and need a lot of data analysis.

Conclusion

Apart from reducing company’s compliance requirements as well as forging strategies for dispute prevention, APA program has also assured revenue flow to the Indian treasury. To address APA issues, Outsourcing subject matter experts from private sector can not only solve human resource crunch issue but will also bring clarity to emerging complexities with their expertise.

Related News

Double Taxation Avoidance Agreement (DTAA)

- India & Mauritius signed (not yet ratified) a protocol amending the Double Taxation Avoidance Agreement (DTAA).

- Amendment included Principal Purpose Test (PPT) to avail tax benefits under the DTAA to plug the abuse of treaty for tax evasion and avoidance.

- PPT lays out the condition that the tax benefits under the treaty will not be applicable if obtaining that duty benefit was the principal purpose of any transaction or arrangement.

- Protocol to amend DTAA is aimed at making it compliant with Base Erosion and Profit Shifting (BEPS) Minimum Standards.

- DTAA between India and Mauritius was first signed in 1982 and amended in 2016.

- Promotion of cross-border investment by reducing tax burden on foreign investors.

- Equitable allocation of right to tax between the ‘source’ and ‘residence’ countries.

- Provides legal certainty on taxing international income.

- Treaty Shopping: Takes place when residents of a country, which is not a party to the DTAA, take advantage of the provisions through indirect routes.

- Double non-taxation: Abuse of DTAA to avoid paying taxes in both countries.

- Differential interpretations of tax treaties leading to protracted litigations.

Base Erosion and Profit Shifting (BEPS)

- Refers to tax planning strategies that exploit gaps and mismatches in tax rules for tax avoidance by shifting profits from higher tax to lower tax jurisdictions.

- Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS aims to update international tax rules and lessen opportunity for tax avoidance by multinational enterprises.

- India signed the convention in 2017.